34+ Debt to income ratio to buy a home

Sellers Market Make Seller Concession For Homebuyers A Challenge. Your housing-related debt-to-income ratio would look like this if you pay 1650 per month for all your housing-related expenses and your gross monthly income is 5000.

Tuesday Tip How To Calculate Your Debt To Income Ratio

Yes ANZ will no longer accept home loan applications with a DTI debt-to-income ratio greater than 9 times a borrowers annual before tax gross income.

. This amount multiplied by 100 equals 428. Imagine a home buyer pays 3000 each month in debt payments and their gross monthly income is 7000. While you may be fortunate.

Calculate the debt-to-income ratio by dividing the 2000 monthly debt payments by the 6000 total gross income to arrive at a debt-to-income ratio of 33. To get the back-end ratio add up your other debts along with your housing expenses. Now lets see what she can afford using the debt-to-income.

For consumers with a good credit history stable income and a down payment of 5 or more most lenders will. Assuming the same gross monthly income of 5000 your DTI ratio increases to 36 after buying a home. Using the above figures Susan currently has a debt to income ratio of 21875 1300 200 250 8000.

To calculate the debt-to-income ratio add all of your monthly debt and divide it by your total gross income. Home prices in San Francisco are the highest in the nation at 1100000 for an average two-bedroom home. The numbers will change depending on whether you use front-end or.

Normally the front-end DTIback-end DTI limits for conventional financing are 2836 the Federal Housing Administration FHA. Lets say youre going through the pre-approval process and your lender comes back with the news that you barely qualify for a mortgage with a 43 DTI. Debt to income ratio is the amount of money owed debt versus the amount of money made income in any given month.

Various loan programs have different DTI ratio requirements. Say for instance you pay. Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage.

A good debt-to-income ratio to buy a house depends on your mortgage program. Your front-end or household ratio would be 1800 7000 026 or 26. Buying a new home is a big deal and buyers should be aware that their debt-to-income ratio will definitely be something that lenders consider when determining just how.

In the United States lenders use DTI to qualify home-buyers. Debt to income ratio is expressed as a percentage. This has been in effect on or after.

Debt To Income Ratio Debt To Income Ratio Home Buying Process Real Estate Information

Stagwell Inc Nasdaq Stgw Reports Results For The Three And Twelve Months Ended December 31 2021

1

15 Debt Payoff Planner Apps Tools Get Out Of Debt Debt To Income Ratio Home Improvement Loans Managing Finances

Defa14a

Just Because You Hear Something Does Not Mean It S True There Are Myths And Then There Are Facts Mortgag Home Buying Debt To Income Ratio Mortgage Rates

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Student Loans Student Loan Help

Bad Credit Home Loans How To Buy A House With A Low Credit Score

Initial General Form For Registration Of A Class Of Securities Pursuant To Section 12 B 10 12b

Is This An Affordable Mortgage For Me Household Expenses Debt To Income Ratio Debt

Debt To Income Cheat Sheet In 2022 Debt To Income Ratio First Home Buyer Income

Private Colleges In Peril Financial Pressures And Declining Enrollment May Lead To More Closures Document Gale Academic Onefile

What Is A Unicap Calculation Quora

Bad Credit Home Loans How To Buy A House With A Low Credit Score

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

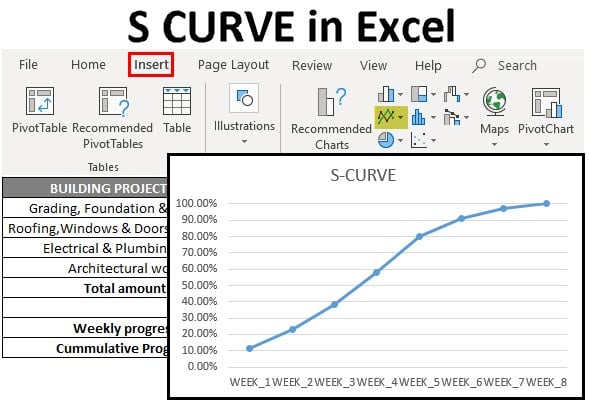

S Curve In Excel How To Create S Curve Graph In Excel

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans